4 Ways Investing for Retirement is a lot like Fantasy Football

- Kyle Hill, CFP®

- Oct 8, 2019

- 11 min read

Updated: Nov 6, 2024

It’s football season! Which means (wait for it)… Fantasy Football!!

Now I know people think fantasy football isn’t for everyone, but I whole heartedly disagree. I’ll get into that at the end though.

The real reason you’re reading this, is that burning question running through your mind, “How is fantasy football like investing for Retirement?"

This is combining two of my favorite things to talk about fantasy football and investing for retirement. There are slews of information out there on the inter webs (the internet) about the two. There are different platforms to play on (for fantasy football, I like the ESPN platform personally, because I’m a company man; for investing I use TD Ameritrade). There are even tv shows and podcasts about the two.

For fantasy football, I prefer the ESPN Fantasy Focus podcast with Matthew Berry (in addition to Field Yates, Stephania Bell, and Daniel Dopp). Not only does the podcast bring an in-depth analysis to help me crush my weekly opponents, but it also provides a big slice of humor, mostly instigated from Matthew, that makes analysis of the numbers entertaining (hopefully similar to what you’re getting out of this blog) and easy to digest.

I mention this, because at the start of every football season (and therefore fantasy football season), Matthew Berry writes his Draft Day Manifesto. It’s a fantasy football guide to drafting your fantasy team for the upcoming season. Every season has a different story and new stats for analysis, but he always leads off with this advice,

"It's a question of what’s most likely to happen.”

Yes, there is an element of luck involved, I won't deny that, but a large portion of your outcomes is answering the question: what's most likely to happen?

Take this for example. What’s more likely to happen, Patrick Mahomes throws 40 touchdowns this season or the Dolphins third string running back leads the NFL in rushing? (hint: Patrick Mahomes is pretty good, and the Dolphins look horrible on paper… and in real life so far.)

It’s kinda like asking if it’s more likely that Apple is going to sell a bunch of iPhones this year or if Tesla is going to sell the most automobiles out of all the car manufacturers. (hint: Apple is the king of smartphone users in the U.S., and Tesla doesn’t have the capacity to match the competition)

Most everyone would say Mahomes and Apple are the responses most likely to happen. It doesn’t mean they will happen, but it’s more likely that they could.

Nothing is guaranteed in fantasy or in investing.

So what lessons can fantasy football give us about investing for retirement?

1. Don’t gamble with your number 1 pick

You wouldn’t go all in and pick a defense or a kicker with your first round draft pick. The same is true for your retirement portfolio. You want to invest majority of your portfolio in good, fairly predictable options.

Now we can’t predict the future, but if you look at what the market has done over time, and you believe that the United States and the global economies are going to continue to grow, in the long run, then we can make the general assumption that there are investment options that a will be worth more in the future.

Take for example the S&P 500 index. This is an index of the 500 largest companies in the U.S. stock market. They’re big companies, that are well established. They have a track record.

According to Investopedia, since it’s inception in 1926, the S&P 500 Index has averaged about a 10% annual rate of return. Some years it’s more, some years it’s less, but on average, it evens out to around 10%. (Note: This isn’t a guarantee of future performance, this is just an example.)

That’s fairly predictable if you’re looking at a long time horizon (greater than 10 years), right?

Now, what’s not as predictable is a flyer.

If you’re going to take a “flyer”, you do that in the late rounds of your fantasy draft. If it works out, great. It could end up being a big pay day, or even a league winner! If not, no big deal because it was one of your last picks. You didn’t sink a bunch of value into that pick. It’s not going to lose you your league.

Same is true for your retirement portfolio. If you want to take a gamble on a company stock or something like bitcoin, make it a small position in your portfolio. These are very unpredictable investments.

I get it, many of these companies are great.

Imagine if you would have bought Apple (AAPL) or Amazon (AMZN) stock when they went public. You could be sitting pretty right now… but what happens if these companies fail to innovate and sales decline or they become subject to new government regulation that hampers their growth or they get bogged down with legal troubles? I’m not saying that’s going to happen, but what if? This is the chance you take if you invest in individual stocks.

For every Apple or Amazon success story, there are companies that don’t make it. Think about JC Penny or Sears. These were once successful business that have now been demoted to the practice squad and on the verge of being cut. Imagine people in the 1980’s, they still shopped from the Sears catalog. I remember as a kid flipping through the pages of the two inch thick Sears catalog, marking every page with highlighter circles to indicate I wanted everything! It was the greatest thing that dreams were made of. We never would have thought of shopping online. Now Sears and JC Penny are struggling to survive.

The company might appear great, but that’s what they said about Enron. Employees that had their entire retirement portfolio in Enron stock lost everything.

I won't get started on bitcoin. (but if you're curious, ask yourself: Is it an investment or is it a currency? Those responses have different answers.)

The bottom line is, in fantasy football redraft leagues, you get a do over next season. With your retirement, there are no do-overs. Don’t risk it all on a flyer!

2. Don’t neglect positions

When you draft in fantasy football, there are several strategies about your roster construction. Do you go zero RB? Do you go zero WR? Do you draft two QBs or roll with just one?

Obviously, it all depended on where you’re drafting and the talent pool, but if you load up on WRs in the first three rounds, you’re probably going to be hurting at your RB positions. A well balanced draft will typically yield you better results and cause you less stress over the course of the season, rather than trying to scour the waiver wire to fill your RB slot because you went WR with your first three picks. If you have a stud WR and a stud RB, you can typically fill in the gaps.

Same is true for a well balanced portfolio. You don’t want your retirement portfolio concentrated all in one stock or one asset style. You want to diversify your portfolio like you diversify the positions you draft. Spread your investment dollars over multiple asset classes. You want some Large Cap, Mid Cap, Small Cap, and International.

Depending on your situation and stage in life, you may want some bond exposure in your portfolio. It’s kinda like having Frank Gore in your line up. Generally, it doesn't have the upside of equities (stock), especially in this low interest rate environment, but it provides you downside protection. It’s pitched as stability. It’s not going to win you your league, but depending on your situation it could help you sleep at night. (Note: This is not a recommendation for an asset allocation. Investment allocation and decisions should be based on your individual situation.)

The bottom line, spread your money around.

3. Don’t drop a player because of one bad week

Going into week 1 of the football season, you put the players in your line-up that you think will perform best. You’ve bought into the hype, coming out of training camp, about David Montgomery. You believe Devante Adams will be the #1 receiver in fantasy this year. You’ve done the analysis, you’ve looked at the ESPN positional rankings, and you’ve even listened to podcasts all week about fantasy football.

Then, those players that you believed in so much, to take you to fantasy glory, don’t live up to the hype. They stunk it up, and it cost you your weekly match-up.

Think twice before throwing Adams to the bench. Don’t you dare drop Montgomery. It was one week! Things happen. Be patient.

This is the same when it comes to investing your money.

After you get your portfolio set up and your dollars invested, be patient. Don’t be too quick to make changes. Give it some time to play out.

Also, understand what you’re measuring your investment against.

It wouldn’t be appropriate for me to compare WR DeMarcus Robinson's performance to WR DeAndre Hopkins. It’s not an apples to apples comparison.

You probably drafted Hopkins with your first round draft pick, and expect him to be a scoring workhorse in your weekly line-up.

With Robinson, you probably got him off waivers at little to no cost, after Tyreek Hill got injured, thinking someone has to be on the receiving end of Patrick Mahomes passes, right?!? He’s a gamble, and you don’t know what to expect from him. Sure, there could be weeks that he outscores Hopkins, but for the season, you expect Hopkins to outperform Robinson.

Same is true for your investments.

If you have a Small Cap fund, it wouldn’t be an appropriate comparison, comparing it to the S&P 500 index (Large Cap index).

The S&P 500 index is a lot like DeAndre Hopkins, and the Small Cap Fund is like DeMarcus Robinson. You have different expectations around the players and the investments. If you’re looking at a Small Cap fund, you should be measuring it against an appropriate Small Cap index if you want an apples to apples comparison.

You might be asking, why not just invest in all Large Cap then? Good question. We want to diversify.

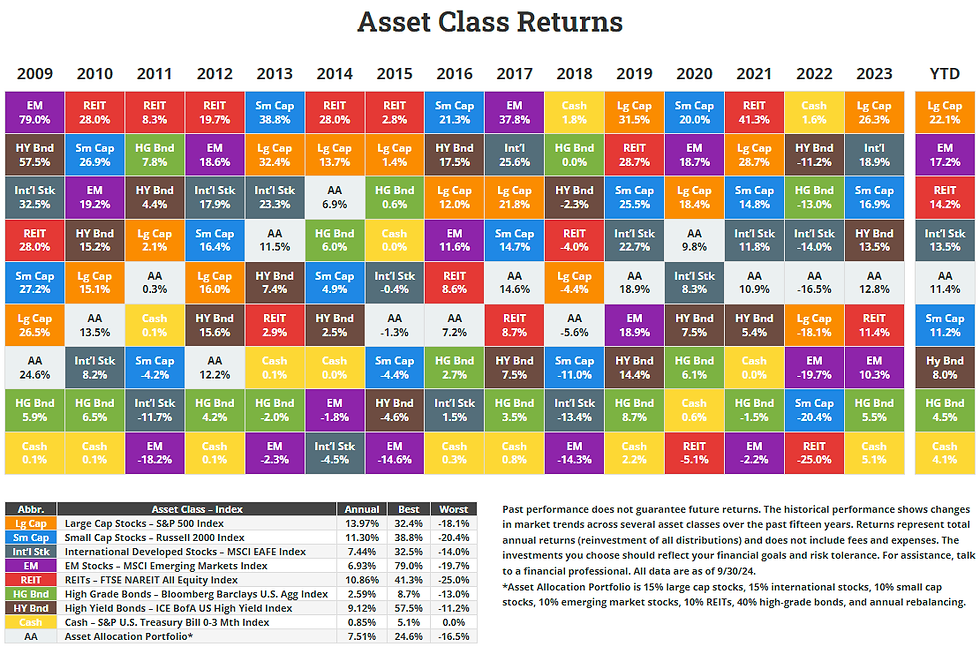

Take a look at the chart below. This shows you how different asset classes perform year over year. The top performer isn’t always the same year to year.

(Asset Class Returns courtesy of Novel Investor.)

Now if an investment is consistently underperforming, then you want to look at cutting your losses to find a better replacement.

4. Chasing Winners is a Losing Strategy

I understand, investing can be confusing. Often times you go in hoping you drafted the right fund for your investment portfolio. Unfortunately, we won’t know for sure until the season is over and we’re tallying up the balance in your account, as you head into retirement.

You can always look back and say, "that fund out performed my fund, I should have chose it.”

Hindsight is 20/20.

Just because a fund outperformed your fund this year, doesn’t mean it will outperform it next year. It’s kinda like when some player on waivers has a huge unexpected week.

Thinking this must be a thing, you rush to get him, while dropping a serviceable bench player. You throw this newly acquired diamond in the rough into your line-up and he’s a dud.

Then, thinking it was a fluke, you play him in your line-up again.

Another dud.

One more chance with this guy in your line-up because the fear of missing out (FOMO).

Another dud.

This guy single handedly sinks your team, you miss the playoffs, and you're holding the Sacko.

Meanwhile, the bench player you dropped, was elevated to a starting role, and finished the season as a top 20 player.

This is a lot like investing, and chasing winners has been proven to be a losing strategy (in investing).

5. Don't Just Draft Players, Draft the Whole Team (BONUS)

Now in fantasy football, you have to choose one player per draft pick (except for defense). Some are clear cut decisions, like RB Saquon Barkley for the Giants. The dude is a stud and you know he'll perform.

But what about choices like picking from the Rams wide receivers? It's starting to shake out much differently now, but all three of their top WRs were being drafted in the same area. You just didn't know which one was the clear cut guy you wanted before the season started. It was a gamble either way you went... but what if you could have all three of them? Or the whole team?

That's the approach I recommend my clients invest. Don't just pick one when you can have a slice of them all.

That's kinda what mutual funds and ETFs do for you. Rather than going all in on Wal-Mart, or Amazon stock, you get a little bit of all them.

Yes, if Cooper Kupp goes off for 35 fantasy points (that's a good game!), you don't get all of those points, you get a slice of them. However, you also get a slice of Brandin Cooks, Todd Gurley, Jarred Goff, Robert Woods, and the rest of the Rams' points.

So maybe you lose a little upside, but you have a more reliable and more steady stream of points coming in each week. When you're dealing with your future, wouldn't you like to have a little more predictability?

Oh by the way, back to Saquon Barkley. Mutual Funds and ETFs also help prevent the downside compared to individual stocks (or bonds).

When Saquon is playing, he's going to perform, but as we've seen recently, when he's injured, he's sitting on your bench scoring zero... and that doesn't help you. As Matthew Berry would say, "#Analysis".

With mutual funds and ETFs, if you have a Saquon type company in your portfolio that has something bad happen, they don't destroy your entire investment. They might be a little drag to your investment, but the other companies in your investment (ETF or Mutual Fund) help counteract or minimize the impact.

Get the team, not just the player.

Looking for Help with Your Investment Draft (and All the Other Financial Stuff)?

I hope this helped you see investing in a different way, and a more understandable way.

Much like there are fantasy football advice sites out there, I provide financial advice to young professionals to help them figure out what to do with their money. I help you cut through the confusion, so you can make the best picks for your current financial season, and your personal financial dynasty.

If you could use professional help with your financial roster from an independent, fee-only, CERTIFIED FINANCIAL PLANNER™, schedule a FREE 30-MINUTE INTRO call today! We could be a great team for your finances.

Why I Want You to Try Fantasy Football

As promised, last thing I'll mention, if you don’t play fantasy football, I want to encourage you to give it a try. I know not everyone likes the NFL, and there’s some good reasons out there. My pitch goes beyond the NFL. It’s about bringing people together.

In a world that has become so polarized, it gives people a break from reality to converse over this meaningless game.

You don’t have to be in shape.

Anyone can play it.

Personally, I don’t know how many times I’ve used fantasy football as an icebreaker at a random event where I didn’t know anyone. For me, it just happened over the weekend at a kids birthday party.

It breaks down the barriers to the weird, standing there silence while you look at your phone insistently.

It doesn’t have to be for money.

Just have fun with it and get people talking.

Rekindle those old college friendships with your old roommate that lives across the country now.

Try Fantasy football and give the family something to talk about over Thanksgiving Day turkey… and real football, of course! I mean, I just wrote a blog about it, related it to personal finance, and you read it. So give it a try! You can always quit if it's not your thing.

In the words of Matthew Berry,

Kyle Hill, CFP® is a CERTIFIED FINANCIAL PLANNER™ professional that is based is Kansas City, MO and serves clients Nationwide. He is the owner, founder, and financial planner of Hill-Top Financial Planning, LLC, an independent, Fee-Only registered investment advisor in the state of Missouri that provides comprehensive financial planning, and investment management services to young professionals and families. Kyle helps clients build custom, personal financial plans to help them bring clarity to their financial situation so they can build wealth and become financially independent. He helps clients with a range of personal financial topics ranging from: budgeting, cash flow planning, investing, retirement savings, college savings, insurance planning, tax planning, and much more. Hill-Top Financial Planning, LLC serves clients as a fiduciary and never earns a commission of any kind.

Comments